From Distress to Dividends

A Portfolio Built for the Next Cycle of Commercial Real Estate

Redefining the Future of Private Real Estate Funds

Across the U.S., office properties are trading 30–50% below replacement cost, creating one of the few remaining value gaps in commercial real estate. Simultaneously, flexible-office demand has surged 60% since 2020, and hybrid work adoption now exceeds 65% of corporate tenants.

The PILLAR Real Estate Fund turns this convergence into performance: discounted acquisition cost, immediate leasing traction, and durable yield, without dependence on speculative recovery cycles.

As a next-generation leader among private real estate funds, PILLAR focuses on disciplined buying, precise execution, and stable income delivery through adaptive leasing.

For accredited investors, the portfolio offers early participation in the recovery itself well before the broader market catches up.

Confirm Your Investor Eligibility

Participation in the PILLAR Fund is open exclusively to accredited investors. This ensures alignment between our strategy and the sophistication of those we serve.

To qualify, investors must meet at least one of the following criteria:

Net-Worth Threshold

A personal or joint net worth of $1,000,000 or more, excluding primary residence

Income Threshold

Annual income of $200,000 individually or $300,000 jointly

Professional Credentials

Holders of certain FINRA licenses (Series 7, 65, or 82)

As part of our compliance process, third-party accreditation verification may be required before access is granted to full investment materials, including the Private Placement Memorandum (PPM) and Limited Partnership Agreement (LPA).

Why Invest in Office Assets Today

The Most Undervalued Class in Today’s Market

While most real estate sectors remain fully priced, office buildings stand out as the only major asset class trading at deep discounts. Across U.S. markets, high-quality properties are selling 30–50% below replacement cost, opening an $85.8 billion window for disciplined buyers.

These price dislocations are not permanent. As lending stabilizes and corporate occupancy rebounds, values will normalize. By acquiring before the recovery, the PILLAR Real Estate Fund positions investors to capture both immediate income and significant upside appreciation.

Each acquisition is selected for its intrinsic value, location fundamentals, and leasing potential in a returning office economy, an approach that aligns with the most proven real estate investment terms in institutional practice.

Why Lease to Flexible-Workspace Operators

Stable Demand. Adaptive Income.

Within the broader office market, flexible workspace tenants like Regus represent the strongest source of near-term and structural demand. Their model converts large, underutilized space into active, revenue-generating environments that cater to today’s hybrid workforce.

Leasing to a Regus operator gives each PILLAR property instant occupancy, steady traffic, and diversified revenue streams. A single location can draw hundreds of professionals weekly, creating visibility and momentum that attract additional long-term tenants.

More than 60% of companies now support hybrid work, and flexible offices are projected to comprise 30% of global office inventory by 2030. Regus-anchored buildings within the PILLAR Real Estate Fund’s portfolio remain productive, relevant, and cash-flow positive, delivering measurable real estate investment ROI through all market cycles.

Regus: The Global Standard

The Anchor Tenancy Powering Steady Portfolio Growth

Since 1989, Regus™, the largest division of IWG (International Workplace Group), has pioneered the global shift toward flexible workspace—long before “coworking” became a movement.

Today, it operates over 3,000 centers in 120 countries, providing professionals and companies access to space as a service, not a lease.

For the PILLAR Real Estate Fund, having Regus franchise operators as anchor tenants provides an immediate foundation of occupancy, credibility, and leasing momentum. Their presence attracts daily traffic, strengthens broker engagement, and enhances the visibility of each property, accelerating stabilization and rent growth.

Because Regus serves a broad, diversified customer base, each location benefits from sustained demand and resilient revenue across market cycles.

Inside a Regus Flexible Workspace

Private Offices

Fully serviced suites leased to established businesses provide stable, recurring rent streams

Shared & Collaborative Workspaces

Open, flexible areas attract freelancers, consultants, and small enterprises seeking professional community

Virtual Offices & Business Addresses

Digital memberships offer business presence and services without physical space

Meeting & Conference Rooms

Fully serviced suites leased to established businesses provide stable, recurring rent streams

The Chicago Regus Center

The Fund’s Proof of Concept

Acquired in 2023, the first Regus center in Chicago, IL marked the fund’s initial proof of concept: a modest acquisition transformed into a stabilized, high-yield asset that demonstrated the power of disciplined repositioning.

Its performance established the foundation for the fund’s scalable model, validating both the operational strategy and market thesis behind its expansion.

- Acquisition Year: 2023

- Acquisition Price: $100,000

- Current Annual Revenue: $660,000

- Annual Distributions: $120,000

- Occupancy: 95% within 18 months

- ROI: 120%

- MOIC: 10x

- CAGR: 115%

- Current Valuation: ~$1 million

Scaling Without Dilution

Expansion Strategy & Scalability

The PILLAR Real Estate Fund’s growth is methodical. Each new location follows a refined operational playbook: identify markets with rising professional populations, secure undervalued assets, reposition for flexible workspace use, stabilize income, and reinvest cash flows into the next acquisition.

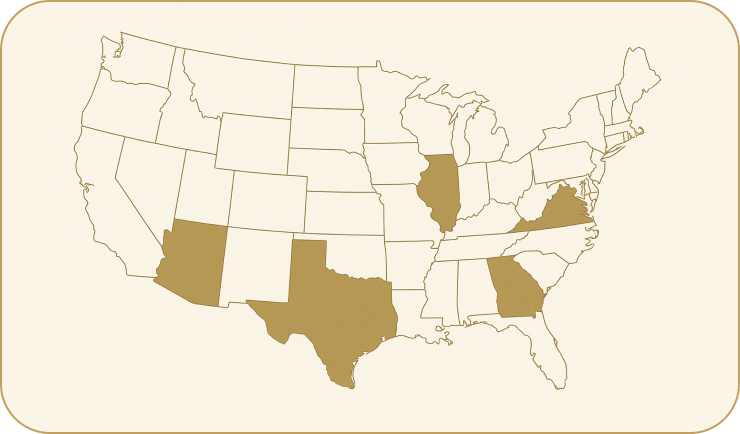

These states were selected through comprehensive evaluation of demographic trends, business migration, and market liquidity, each representing attractive entry points for below-replacement-cost acquisitions and long-term appreciation.

The fund’s disciplined approach exemplifies how private real estate funds can deliver institutional precision with entrepreneurial agility. It’s a playbook that defines modern real estate investment terms and produces performance measured in both yield and resilience.

Texas

- CRE Market: $1.5 trillion

- Population Growth:

+4M since 2010, the fastest-growing state nationwide - Economic Drivers:

Dallas–Fort Worth, Houston, Austin, and San Antonio lead in technology, energy, healthcare, and financial services - Market Fundamentals:

Deep office inventory, resilient demand, and attractive cost basis for repositioning - Investment Outlook:

Continued corporate migration and population inflows position Texas as a cornerstone for scalable yield and appreciation

Arizona

- Population Growth:

+1M since 2010, among the nation’s top-five growth states - Economic Drivers:

Phoenix continues to expand as a hub for technology, logistics, and professional services - Market Fundamentals:

Healthy occupancy rates, supply balance, and strong absorption of flexible office space - Investment Outlook:

Ideal for early-cycle acquisitions with near-term cash flow and long-term appreciation potential

The Carolinas

- Population Growth:

+2 million since 2010, driven by sustained domestic migration and corporate relocation - Economic Drivers:

Charlotte’s emergence as a national financial hub; Raleigh-Durham’s expanding innovation ecosystem - Market Fundamentals:

Strong absorption, manageable new supply, and a robust mid-market office sector - Investment Outlook:

Attractive yield-to-risk profile within stable, high-growth metropolitan economies

Built for Investors Who Move Before the Market

The next cycle of performance is already in motion. The PILLAR Real Estate Fund identifies, acquires, and repositions undervalued assets before the recovery begins, capturing income today and appreciation tomorrow. For sophisticated investors seeking a forward-thinking real estate investment group, this is where disciplined capital meets visible performance.

Disclosure

The PILLAR Real Estate Fund is offered exclusively to accredited investors under Regulation D of the Securities Act of 1933. This material is for informational purposes only and does not constitute an offer to sell or a solicitation to buy securities. All investments involve risk, including possible loss of principal. Past performance is not indicative of future results. Investors should carefully review the Fund’s Private Placement Memorandum (PPM) before making any commitment.